⚠ TO VIEW THE PORTFOLIO CLICK ON THE "PORTFOLIO TAB" ABOVE ⚠

December Contributions: $3,025

December soundtrack: 🔊 🎶 ❤ Trey Songz - Na Na ❤, Ciara - Oh ft. Ludacris, Lloyd Bank - I'm so fly, Mobb Deep - Shook One's Pt. II, Young Thug - London ft. J. Cole, Travis Scott, ❤ Akon - Locked up Ft. Styles P ❤. Added bonus: Trey Songz - Na Na (Slowed + Reverb) 🔊🎶 #freshmoney

Sometimes I ask myself, "do I even belong in this niche?"..........next thing you know I get a notification saying 10 people recommend my Facebook page, then I get 5 new followers. Then I'm like "oh ok never mind". In the past, I always thought I was going be on Twitch TV live streaming video games but somehow.........I ended up here. So welcome back to the blog, 2021 has come to a close. So this is the year-end blog update. This month I have added another single stock from my very strict watchlist. Scroll through the dividend income below to continue. ⬇⬇⬇

Roth IRA

Total: $134.75

Taxable Account

Total: $22.60

Grand Total: $157.35 (new record)

Purchase: 3 shares of (INTU) ($1,908.49) & 4 shares of (ODFL) ($1,408.39)

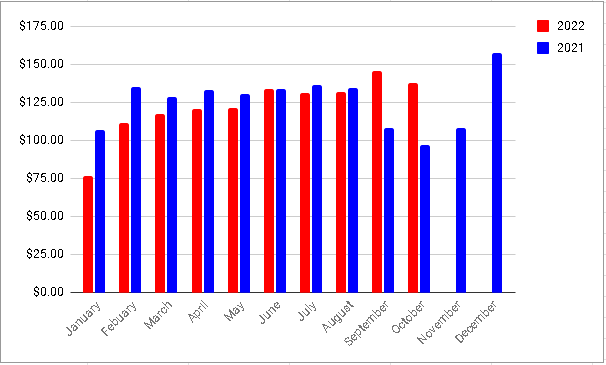

2021 Grand Total: $1,508.74

(Keep scrolling ⬇⬇⬇)

(Company summary)

Intuit Inc. provides financial management and compliance products and services for consumers, small businesses, self-employed, and accounting professionals in the United States, Canada, and internationally. The company operates in four segments: Small Business & Self-Employed, Consumer, Credit Karma, and ProConnect. The Small Business & Self-Employed segment provides QuickBooks online services and desktop software solutions comprising QuickBooks Online Advanced, a cloud-based solution; QuickBooks Enterprise, a hosted solution; QuickBooks Self-Employed solution; QuickBooks Commerce, a solution for product-based businesses; QuickBooks Online Accountant and QuickBooks Accountant Desktop Plus solutions; and payroll solutions, such as online payroll processing, direct deposit of employee paychecks, payroll reports, electronic payment of federal and state payroll taxes, and electronic filing of federal and state payroll tax forms. This segment also offers payment-processing solutions, including credit and debit cards, Apple Pay, and ACH payment services; QuickBooks Cash business bank account; and financial supplies and financing for small businesses. The Consumer segment provides TurboTax income tax preparation products and services; and personal finance. The Credit Karma segment offers consumers with a personal finance platform that provides personalized recommendations of home, auto, and personal loans, as well as credit cards and insurance products. The ProConnect segment provides Lacerte, ProSeries, and ProFile desktop tax-preparation software products; and ProConnect Tax Online tax products, electronic tax filing service, and bank products and related services. It sells products and services through various sales and distribution channels, including multi-channel shop-and-buy experiences, websites and call centers, mobile application stores, and retail and other channels. The company was founded in 1983 and is headquartered in Mountain View, California.

I'm going to list some of (INTU) stats: starting dividend yield = 0.50%, Dividend growth CAGR (Compound annual growth rate) 3 year = 13.88% 5 year = 14.69% 10 year = 32.70%. Dividend payout ratio = 23.27%, currently has 10 years of dividend growth. Current Market cap is ~ $150 billion.

Over the last 5 years, Intuit has grown its dividend by 73.75%

10 year Total Return Comparison

During this little market correction at the start of the new year ill be buying even more (INTU) throughout the first quarter of 2022. You can notice the sharp dip at the end of the Total Return comparison next to Apple. I ONLY stick with high convictions so when the market takes a dip you are motivated to buy even more shares because the core metrics are still the same so now I can in at a cheaper price. Consistent momentum over 10, 15, & 20-year time frame in stock price, revenue growth, net cash flow, dividend growth, ROIC (return on invested capital). After a while, I'm gonna sound like a broken record because I'm repeating the same metrics over and over again. There are about 25 different metrics I look at but I just list the main ones that anyone can understand. Have you noticed that EVERY single pick that I've revealed from my personal strict watchlist has either outperformed or just barely trailed behind AAPL (Apple). In 2021 Apple had a 30% return on invested capital.............as of today I don't think any of my strict picks comes close to that. Having a single stock like AAPL as your personal custom S&P 500 benchmark causes you to look for the strongest metrics in the game. It feels like I'm playing the Yu-Gi-Oh duel monsters card game when I was like 10 years old. My parents would drop me off at school early, and I would be in the cafeteria trading duel monsters cards. Trying to build a stronger deck, by trading out the weaker magic cards, trap cards & monsters cards for stronger ones that have better stats. Definitely loved watching the cartoon show as a kid (I'm definitely going to watch it again on Netflix when I finish this). Scroll down to get to the revenue breakdown.

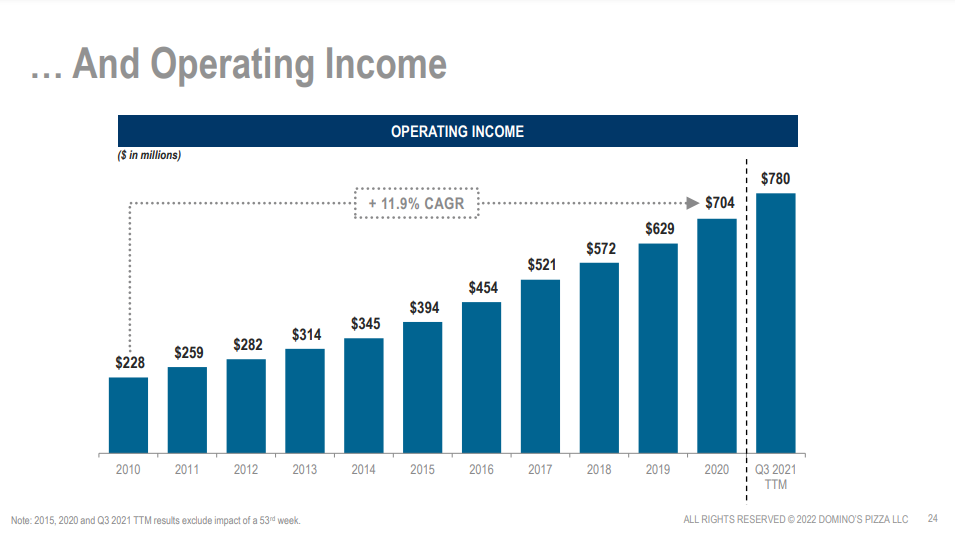

For example, if the net cash of a low dividend yeilding/ low payout ratio high growth company is let's say.............$250 million and the cost of the dividend payout is $75 million a year. There's a gap of $175 million between the net cash flow and the running cost of the dividend payout. Then the following year the net cash flow grows to $350 million and the running cost of the dividend payout is raised to $125 million. That leaves a gap of $225 million, seeing that gap consistently grow year after year while giving out 10%, 15% or even 20% dividend raises is very attractive. Low dividend payout ratios are the sh$t. You know what...........I'm ready to watch some Yu-Gi-Oh on Netflix. So i hope everyone had a great New Years, and I am soooooooo ready to abosultely destroy 2022. So ill see you guys in the next update.