⚠ IF YOU WANT TO VIEW THE PORTFOLIO CLICK ON THE "PORTFOLIO" TAB ABOVE ⚠

What's going on fellas? Welcome back to another blog update, Total contributions for October is $1,900. October's soundtrack 🎶: Mase - Looking at me ft. P. Diddy, DMX - What they really want ft. Sisqo, OutKast - Ain't no thang, ❤Akon - Smack that Ft. Eminem ❤, Eminen/Dr. Dre - Forget About Dre ft. Hittman 🎶 Got a little hint of James Brown in my walk. My personal net worth growth feels like a rocket ship 🚀

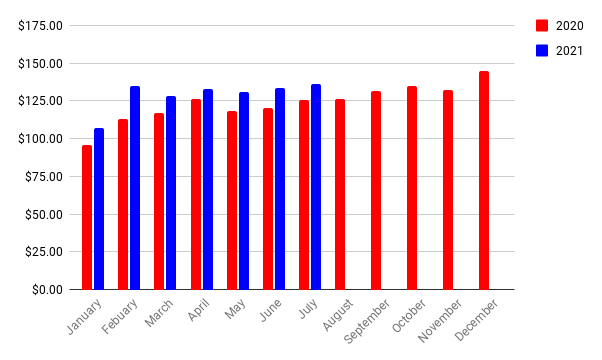

(#Realist dude in the game) btw ignore the dip in dividend income, it will bounce back into the $110 - $115 range. That's what happens when you make changes in your portfolio. November should be around $110, but I'm just out here getting money as usual. The Taxable account by itself could hit $100,000+ in 2 years flat from today. What's happens when your young and cold-blooded? A 16 hour day feels like 6 hours, a 14 hour day feels like 4 hours and a regular 8 hour day feels like 2 hours. Just imagine what's gonna happen once I get my hands on a CDL class A license. I may just sit with American Eagle 🦅 a while longer and keep rolling smooth investing $2,000+ a month, I'm in no rush. Btw been seeing a whole lot of new people following my page and like 3 people recommended it this month..................dam. I'm just a young dude out here getting money, and my Facebook page is growing at a faster rate than some of the more serious well-maintained pages in the same niche. Can you explain that to me?

Interesting stuff, but anyways let's continue by scrolling past the dividend income so I can talk about the 2 new stock purchases. One replaces (Qcom) for better total returns/ dividend growth and the other is from my strict watch list. A very strict watchlist that was built by using Apple (AAPL) as a baseline benchmark...........I have a feeling that all the Apple fanboys/fangirls are going to love me for this lol. It wasn't an emotional choice, it's just an honest solid single stock benchmark I came up with that fits the criteria of my unique Total return/ dividend growth investing style. Btw AAPL will in fact be one of the last stocks added into the taxable account.

Roth IRA

Total: $87.56

Taxable Account

Total: $9.37

Grand Total: $96.93

Purchases: (Roth IRA) - 7 shares of CLX ($1,130.26) & 6 shares of AVGO ($3,006.87), (Taxable Account) - 2 shares of MSCI ($1,279.22)

Sells: all shares of QCOM ($3,890.29) ~ +99% profit gain

So as you just read above I sold my entire position in QCOM and reinvested most of it into my new holding AVGO. pretty much doubled my money throughout the 5G wave and invested it into something better. Stronger total returns & stronger dividend growth. I'll explain more about my new purchases below. I also bought into another new stock MSCI from the strict watchlist that I've been teasing about for the last 4 months. (Side note: AVGO was not on the strict watchlist)

(Company summary from Seeking Alpha)

Broadcom Inc. designs, develops, and supplies semiconductor infrastructure software solutions. It offers semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company's infrastructure software solutions enable customers to plan, develop, automate, manage, and secure applications across mainframe, distributed, mobile, and cloud platforms. It operates through two segments, Semiconductor Solutions and Infrastructure Software. The company was incorporated in 2018 and, is based in San Jose, California.

So basically AVGO is another semiconductor stock that I've been watching for a while. So I've decided to sell all my QCOM shares and replace it with AVGO. For better total returns/better dividend growth. It's that simple, you'll see below that I simply compare total returns/ dividend growth and I look through a long list of different metrics behind the buisness. A solid upgrade to the Roth IRA, if I'm not going to fund this that much anymore I might as well go in there give it a better make over before I leave it alone. Like I said last month more changes coming to the Roth IRA next year.

(AVGO) Broadcom

Im going to list down its current stats. Dividend yield: 2.56%, Dividend payout ratio: ~51%, Dividend growth averages: 3 year CAGR = 39.88% , 5 year CAGR = 49.32%, 10 year CAGR = 48.29% (CAGR = Compounded Annual Growth Rate) This stock currently has 10 years of aggressively growing its annual payout per share. Most recent dividend raise was 10.8%. I'm 100% bullish that the business will continue give out solid double digit dividend raises in the future. As you'll see below is the Total returns comparison of the last 10 years, with AAPL set as benchmark.

AVGO Dividend Growth

You see what I mean with paying attention to the actual numbers behind the dividend growth. In this 6 year chart I put together, the annual dividend payout per share has grown by over 471%. I only have 6 years in this presentation, it has been growing it's dividend for the last 10 years. So this is definitely a long term hold, I let this solid pick sit in the Roth IRA.

(Company summary from Seeking Alpha)

MSCI Inc. ,together with its subsidiaries provides ,investment decision support tools for the clients to manage their investment processes worldwide. The company operates through Index, Analytics, and All Other segments. The Index segment primarily provides indexes for use in various areas of the investment process, including indexed product creation, such as ETFs, mutual funds, annuities, futures, options, structured products, over-the-counter derivatives; performance benchmarking; portfolio construction and rebalancing; and asset allocation, as well as licenses GICS and GICS Direct. The Analytics segment offers risk management, performance attribution and portfolio management content, applications, and services that provide clients with an integrated view of risk and return, and an analysis of market, credit, liquidity, and counterparty risk across various asset classes; various managed services, including consolidation of client portfolio data from various sources, review and reconciliation of input data and results, and customized reporting; and HedgePlatform to measure, evaluate, and monitor the risk of hedge fund investments. The All Other – ESG segment provides products and services that help institutional investors understand how environmental, social, and governance (ESG) factors impact the long-term risk and opportunities in financial markets; and data and rating products for use in the construction of equity and fixed income indexes and issue index-based investment products, as well as manage, measure, and report on ESG mandates. The All Other – Real Estate segment includes research, reporting, market data, and benchmarking offerings that provide real estate performance analytics for funds, investors, and managers; and business intelligence to real estate owners, managers, developers, and brokers. It serves asset owners and managers, financial intermediaries, and wealth managers. MSCI Inc. was founded in 1998 and is headquartered in New York, New York. Side note: In 1986, Morgan Stanley licensed the rights to the indexes from Capital International and branded the indexes as the Morgan Stanley Capital International (MSCI) indexes.

So as you just read above, Morgan Stanley is a part of this very unique Tech/ Financal Index tracking aggressive growth stock. You could say that this is basically my first bank related stock, but it absolutely destroys JPmorgan, Bank of America, & Wells Fargo under the key metrics of Total Return combined with Aggressive dividend growth. I'm not very nice when it comes to single stock investing, because I purely analyze and compare the actual numbers/performance behind my long list of metrics behind the buisness. for an example over the last 10 years: Total return, Raw price return (no dividends included), YoY revenue growth, ROIC (return on invested capital), YoY free cash flow growth, dividend growth performance (how often does the annual dividend payout doubles in size? Is it every 4, 5, or 6 years?) Dilluted shares & share holders equity (how often does business buy back shares which reduces the number of outstanding shares available on the market. With less shares outstanding this gives the shareholders more ownership in the company.............and the list just goes on and on and on and on. I think I go through 25 solid metrics in a business for every......single......stock pick. I just like to explain everything in plain English so know one gets a headache.

Im going to list down its current stats. Dividend yeild: 0.64%, Dividend payout ratio: ~42%, Dividend growth Averages: 3 year CAGR = 23.77%, 5 year CAGR = 29.49%. The 10 year CAGR will be caculated on Seeking Alpha once MSCI reaches 10 years of dividend growth. This stock currently has 7 years of aggressively growing its annual dividend payout per share. Most recent dividend raise was 33%.

As you can see again, AAPL (Apple) was included in the 10 year Total Return comparison. When you get to the point of making the S&P 500 look like a flat line with your stock picks, your going to need a much stronger benchmark. So one of the greatest and most valuable companies in modern history has earned it's place to be my personal custom S&P 500 benchmark. Btw by default the S&P 500 will always be included in these charts.

MSCI Inc. Dividend Growth

So as I've said before I analyze the actual performance in the annual dividend raises. In this 6 year chart, MSCI Inc. has grown it annual dividend payout per share by 271%. Every single stock pick from my strict watchlist is a high conviction. Btw after I added this stock into my watchlist I discovered that billionaire investor Ron Baron loves this stock. He bought millions worth of shares back in 2014. Quadrupled his money and his yield on cost is through the freaking roof. It's a good feeling when you find out afterwards, that a famous billionaire investor loves your stock pick.

Alright guys that's it for this one, next month I should have $3,000 worth of my new trucking logistics stock pick I hinted about in the past. Another pick from the very stricted watchlist, it has outperformed UPS & Fedex over the last 10 years and I'm very bullish that it will continue to dominate in this niche so stay tuned. So until next time............