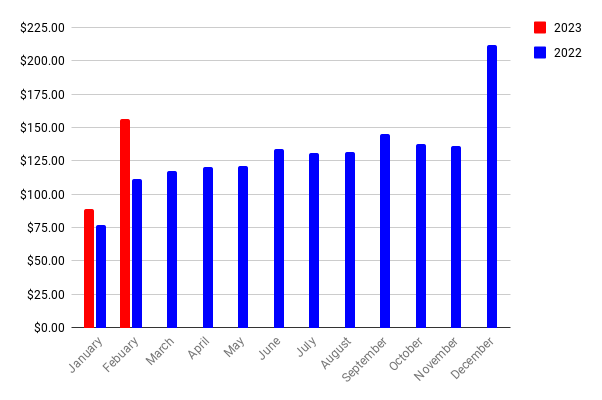

The low yield high growth with double digit dividend increases, which can also be called Total Return investing is doing it's job with the year over year dividend income growth. Basically with the low dividend yield/high growth style of investing you have a very tiny dividend income that grows really fast year over year. With the dividend payout ratio being soo low and the companies aggressive growth in it's net free cash flow year over year it can *AFFORD* to give out 25% dividend increases over and over again. As the dollar amounts gets bigger the effects of a 15%, 20% or even as high as a 30% dividend increase will give you explosive dividend income growth year over year. The dollar amount within the increase gets bigger and bigger. It's like starting off with the weakest weapon in a video game on purpose because when fully upgraded to level 99 it's the most powerful weapon in the entire game. My unique style of dividend growth investing shines with the year over year *GROWTH*, not with the initial dividend income upfront from purchases. To see the dividend income break down scroll down below. ⬇️⬇️⬇️

Taxable Account

Total: $34.87

Roth IRA

Grand Total: $156.46

YoY: 40.68%

Purchases: 2 shares of (INTU)($837.02), & 1 share of (NKE)($366.83)

Dividend increases: (DPZ) - 10%, (MPWR) - 33.3%, (ODFL) - 33.3%

Another short update down, one more to go to end off the first quarter of 2023. My low yield/ double digit dividend growth style will get me past $200 in dividends in a month *before* December of this year. Just sit back and watch. I'll see you in the next update.