Alright guys I'm finally back, I had to finish the Tokyo Olympics before I come back to this. Let me say a few words about the Olympics then ill talk about stock market investing. It sucks sooo bad to see it end already, shoutout to my friends next door 🇲🇽 Mexico and 🇨🇦 Canada. A special shoutout to 🇩🇰 Denmark for being a beast at handball, which is basically soccer and basketball mixed together, its like soccer but instead of using your feet you use your hands to throw the ball into the soccer net. (as an American this is my first time seeing this sport......ever) The Danish helped me discover this badass sport so I cheered for them to win. I first saw them play on tv at the gym when I was jogging on the treadmill, and I was like "what's the name of this sport?" Also last but not least an ultimate shoutout to 🇯🇵 Japan for working hard putting this Olympics together, well done Japan. Im Looking forward to the Winter Olympics ❄

Alright so for the month of July I contributed $1,285 to the Taxable account on $13.34 - $14.14/hr........that's what you call being sooo cold that you become dry ice (straight cold-blooded) Every time you exhale white smoke comes out. These 16 hour days ain't sh$t anymore, it's just a joke to me. Didn't I say some REAL SH$T was going to happen, once you give me more money........I told you. This was literally the first month I received these new raises. American Eagle (the company I work for) is going crazy freaking out because people don't want to come to work and the demand for flying continues to go up. So there just giving out raises back to back. I was just told the other day that another raise is coming soon (this could get interesting 😈)............if Elon Musk saw this he be like.........alright kid now do $2,000+ in a month. I would respond by saying "no problem Mr.Musk challenge accepted" 😈. Anyways let's scroll through the dividend income. Then ill talk about what I'm doing between my 2 accounts.

Roth IRA

Total: $97.90

Taxable Account

Total: $38.32

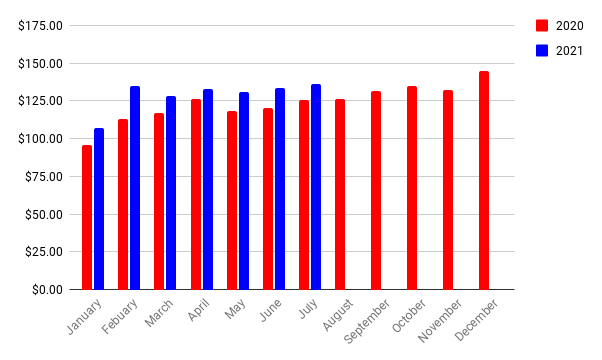

Grand Total: $136.22

YoY:

Purchase: 6 shares of NVDA, 10 shares of MA, 14 shares of NKE, & 7 shares of MSFT

Sell: All shares of PM, ED, & VZ

Alright so as you can see above I completely sold out on (PM) Phillip Morris, (ED) Consolidated Edison, & (VZ) Verizon. Then used that left over lump sum from the sells to purchase more shares of MA, NKE, & MSFT. The reason why I sold is that.........i completely lost all interest. People are going to be like "why did you sell ED, that's a dividend king with 50+ years of dividend raises". Im gonna keep it a 100, are we really going to be all emotional over a stock that's only gone up 113.78% (Total return) in the last 10 years, underperforming the S&P 500 9 out of the previous 10 years. Besides the actual dividend raise performance itself looks like sh$t. It's soo flat, but I'll cut it some slack and say that ED is a classic boring dividend stock thats behind a great slow growth utility business based out of New York. It just wasn't for me. Im not only becoming cold with my contributions, I'm also becoming extremely cold with stock market investing. I may end up hurting some feelings, (just a little warning) but I rather have your feelings hurt than to have your pockets hurt........like for real, for real. You can do whatever you want, im just telling you what I'm doing.

The Roth IRA will also be getting a make-over, like a West Coast Customs kind of make-over. On the real though, I don't care about the Roth IRA that much anymore but I will at least go back in there and reduces my holdings and make it more strictly heavily concentrated. (basically fewer holdings heavier weighted) Having it set up right for the next 30 years. That whole diversification stuff just slows me down, I like the Charlie Munger style better. He personally have said in a video that he would have his entire family trust invested into just 3 stocks. In the world of single stocks........in a lot of ways, you got to be cold if you want to win. I'm at the point now to where all I care about is the expensive high-growth low yielding stocks with aggressive revenue/ free cash flow growth so that every year they always have the available room leftover in their net cash flow to give out high dividend raises. On my very strict watch list, I have a stock that's $625 a share, yields 0.72% thats currently up 41% so far for 2021, and just gave out a 33% dividend raise in late July. 3-year performance = 265% 5-year performance = 630% 10-year performance = 1,773% .The reason why these are soo expensive is that you're pretty much paying a high premium for the high growth and the high dividend raises. (Obviusly there are other variables that come in play with price growth and massive dividend raises, just a basic explanation) All I give a dam about is beautiful stock metrics and businesses I truly understand inside and out, not emotions. (just little sneak peak) Alright, now its time to discuss my new growth stock for the taxable account.

So I bought (NVDA) right after the stock split. The price dipped after the stock split was announced like 2 months prior. In case your wondering this was from my very strict watchlist I mentioned before. Out of all the stocks I own, NVDA with out a doubt my biggest edge. Gaming, computer chips, graphic cards, etc. I understand it all. Believe or not I actually used to build computers back in 2014 when I was in community College. I took a class where you would put a computer together from scratch, plug it into the monitor, start it up and install windows. (We would practice over and over again until we got it right). Heres another story behind this stock.......back in 2012-2013. When I was a junior/senior in high school I was looking up graphics cards and processing chips trying to figuring out how to build a mining rig to mine bitcoin/litecoin. At the time I had no idea I was looking at NVIDIA graphic cards it was just this unique green logo I've never seen before . I was watching like 2-hour long youtube videos on how to put together a mining rig. I was like "as soon as i get my first job I'm saving up so I can start mining bitcoin and litecoin".......true story. I didn't get my first job until like mid-2015 so I forgot about it and it never happened. (Blast from the past) NVIDIA is basically a growth stock I truly understand like the back of my hand, like 2 weeks ago I watched a one and half hour presentation from the Founder & CEO Jensen Huang, I pretty much understood 85% of what he was talking about. Going threw all of his new innovation projects , upgrading their graphic cards to a higher processing rate and etc. basically alot of tech talk. Also I have to say Jensen Huang looks fresh as f$$k in that leather jacket.........now that's my kind a CEO. Basically to end this off, I only invest in business to where I have some kind of edge and the stock metrics have to look top notch as well. So thats pretty much it. Scroll down for the end of this blog post.

$1,285 invested on $13.34 - $14.14

in 1 month. The video below is an example

of when you become straight COLD. (enjoy)

Alright so thats it for this one, I'll be looking forward to hit $2,000 added in a month as I receive more raises. 30 years to hit your first million huh? That's cute you sure about that? 😈 Anyway guys hope you enjoyed and I'll see you guys next time.

TO VIEW THE PORTFOLIO CLICK ON THE "PORTFOLIO TAB" ABOVE