Ok, so I got some good news.......I just finished re-watching season 1 of Ben 10 (the original from 2005). I felt so good reliving my childhood again it was amazing☺....................let me guess you were expecting investing news right? Everyone soo scared to see the market dip down some more again and I'm over here excited to get started on re-watching season 2 of Ben 10 (2005) lol. You know what just forget what I just said go ahead and scroll down to see the dividend income.

Roth IRA

Total: $105.99

Taxable Account

Total: $25.40

Grand Total: $131.39

Purchase: 4 shares of (AAPL) ($692.18) & 3 shares of (DPZ) ($1,185.24)

(AAPL) & (DPZ) are new positions in the Taxable Account. I won't be doing a presentation on AAPL because ............well it's Apple it's a "no-brainer" single stock,........at least for me it is. (AAPL was first added last month) So down below I'll give a little presentation on some of the key metrics I go through on EVERY high conviction single stock I look at when I'm doing my own research and pure due diligence.........which is most important. For me, the real definition is tedious due diligence. I ONLY invest in high convictions. I go through about 20 to 25 different metrics, from metrics like "dividend payout ratio" to "shares outstanding dilution/or buybacks" in the last 10 years and everything in between. Scroll down below to see some of my favorite single-stock metrics.

Dominos Pizza Inc.

In the last 5 years (2017 - 2021) DPZ has raised its annual dividend per share by 104.34%, a little over double the output of the annual dividend payout. With only 8 years of dividend growth history, a 31.85% payout ratio, and a consistent net cash flow growth year over year, Dominos Pizza could easily continue to give out double-digit dividend raises for many years into the future. (DPZ) dividend stats: current yield = 1.2%, 3-year CAGR = 19.35%, 5-year CAGR = 19.42%, when the dividend growth history exceeds 10 years then the CAGR for 10 years will be calculated on Seeking Alpha.com. For those who don't know, C.A.G.R. stands for Compound Annual Growth Rate.

Total Return Comparison

(10 years)

Just a reminder that (AAPL) is like my personal custom S&P 500 benchmark. I didn't choose Apple to be my custom benchmark the stock earned its place to be in my total return comparison. The S&P 500 will always be included as well, so it's like I have 2 levels of stock market benchmarks. So as you see in the graph above im taking advantage of the market decline of 2022 and dollar-cost averaging into (DPZ) as the stock gets beaten down. As of today (9/5/2022) Year to date the stock has declined by -33.88%. When a long-term high conviction single stock takes a hard decline in price I'm excited to buy more and doing so positions my portfolio to benefit well when the market decides to fully recover back to previous all-time highs. Alright so keep scrolling to see the other metrics.

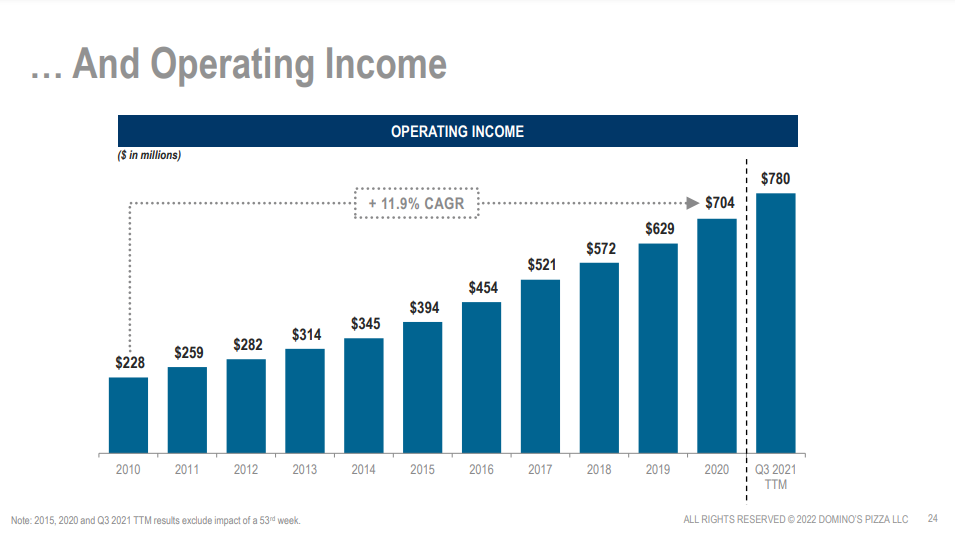

Not much to say other than steady growth year over year, so keep scrolling.

U.S growth is slow and steady but I like that (DPZ) is focusing on international growth.

Consistent quarterly/ yearly earnings growth is very important to me. Especially revenue and net cash flow growth because if they can't consistently grow year over year then they can't consistently afford to give out those double-digit dividend raises. I analyze the increasing gap between net cash flow growth and the rising cost of running the dividend payout. Scroll down some more to see the last metric I have to show.

Revenue and Net Income

(side note: everything is from left to right)

Along with Revenues/Net Income, I also do a deep dive into the balance sheet & cash flow statement. So that are just a few of the metrics I go through before investing in any single stock. Obviously, I'm not going to take a screenshot of all 25 metrics and put you to sleep lol but this will give you an idea of what my research is like behind the scenes. So that's it for this one, I'm going to get started on re-watching season 2 of Ben 10 (2005) and ill see you guys in the next update.