What's going on guys, welcome to the blog. First off let me give a firm salute to our veterans for November 11th "Veterans day". Hope you all had a great Thanksgiving. Usually, I would get fat but I didn't eat as heavy, guess I wasn't feeling it this year. I should also add that I've already hit $4,000 on the dot for my $5,000 savings plan. On $12.63/hr I just put my hands up and say "is this supposed to be hard ???" or am just soo ruthless I make it look easy, I could go for $10,000 if I wanted to but there's no need for me to take it that far I'm ready to get back into investing once I hit $5,000.

Ask yourself this question, .......do you really want to be wealthy or do you just kinda want it but you value your sleep over success. As for myself sometimes it's hard to sleep because I'm ready to go out there and GET IT!!! Bill Gates has slept on the floor in his office many times in the past, Elon Musk now nowadays sleeps on the hard stiff couch in the conference room located inside his Tesla factory. (All true stories go look it up) How bad do you want it? The number 1 thing that these billionaires and I have in common is that we value success over sleep. Alright, so there's a little motivation for today. So let's scroll down and look over this month's dividend income.

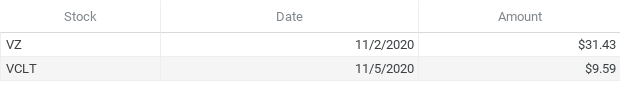

Roth IRA

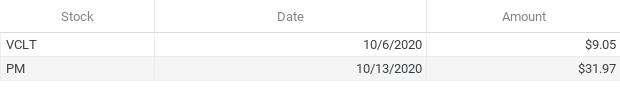

Taxable Account

Grand Total: $132.13

YoY: 24.33%

Purchases: N/A (I'm getting bored with this)😑😑😑

Alright, so this month marks the 5th anniversary of dividend growth investing!!! It's funny how this blog evolved from being this cute little "follow my investment journey" kind of story with like Barney music playing in the background lol, into a full testosterone\ adrenaline-filled RUTHLESS DETERMINATION "$100,000 portfolio before 30" kind of story with like Disturbed 🤘 playing in the background. Talk about a dramatic change lol.

Anyway so since I'm almost done with $5,000 saved, I'll give an update on what ill do with the leftover Roth IRA contributions. My first couple of buys within the Roth IRA should be MCD, CLX, JNJ, KMB, K, & GIS I call these the laid back stocks I just buy more shares and forget about it. I may throw some extra capital at LNT (utility) & AMT because why not I still believe that there's some massive growth leftover in the 5G wave. I only have like $4,500 leftover to work with before I max it out so I'm just going to pinpoint a handful of holdings and call it a day.

What I'm most excited about is my next big project for the taxable account. 3 MASSIVE GROWTH, tiny dividend yield, with MASSIVE DIVIDEND RAISES. Coming soon to theaters near you lol it's a big project guys. I plan to grow these holdings to $10,000 each. The 3 ticker symbols will not be revealed until I purchase them, just going to be giving a tease like this every other month until it happens. It's those massive dividend raises that I'm most interested in, but this project will not begin until after I max out the Roth IRA. Alright guys that's it for this one. Hope you all enjoy the holidays and ill see you guys next time.