What's going on guys welcome back to the blog, hope you all had a great Merry Christmas and Happy New year. So for this month's update, I have a lot to discuss on here. My year to date dividend income, quarterly income, the reveal of my 3 new high growth/high dividend growth stocks, and more. So ill start off by saying that my $5,000+ in savings on $12.67/hr is complete, I'm all fired up (with like a huge wall of blue fire just shooting up 100 feet in the air in the background). It almost felt like a practice run for my $10,000 project in my 3 new stocks each. I feel like a beast that's finally been freed from the chains wrapped around its neck, wrist, & ankles. All the chains unlocked and just fell off. Now I can finally get to come back into investing in dividend growth. It's like I finally get to breathe lol because I never understood what life was like without investing. Like I stated a few months back, at age 19/20 I knew the basic's about investing and hitting your first million early in life........which was right before I set foot into my first job interview. In other words, there's never been one single day that I've had a W2 or filled taxes and didn't know about investing.......pretty crazy right? Looking back in time, I was already obsessed with passive income and building wealth in high school so I was eventually going to come across DGI (dividend growth investing) at some point.

Alright, guys so before we go over the dividend income I want to state that there's been a change of plans with the Roth IRA. I will not be investing into my IRA (as of right now), I'm starting my $10,000 project in my taxable account right now. I'm going to keep it real with you guys, investing in the Individual account feels WAAAAAAY better than the Roth IRA. Much respect to the tax advantages (i have almost $30,000 in the account), but the feeling of knowing that I can access my dividends before the age of 59.5 is the greatest feeling in the world......real talk. That's what gets me to wake up early and do my 16 hour days. I will gladly report taxes every year if that means I get to achieve financial freedom early in my life. Its moments like this, are the reason's why some of my readers have been following me for almost 3+ years because I keep it real in the game. I'm not afraid to say it like it is. Alright, guys let's continue by scrolling down through the dividend income.

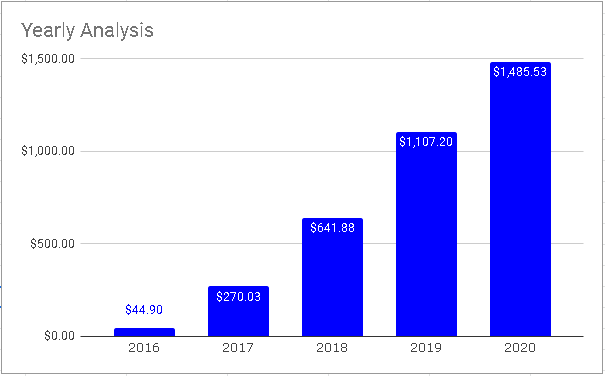

2020 total: $1,485.53

YoY: 34.17%

(Added bonus) Taxable Account produced $406.03

Ended off the year with a new quarterly record of $411.95

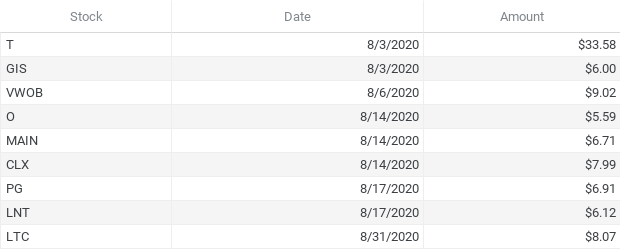

Roth IRA

Total: $105.33

New Record!!!

Taxable Account

Total: $39.30

Grand Total: $144.63 (new record)

YoY: 6.25%

Alright, guys here's the big reveal :)

Sell: All shares of VCLT

Buy: 5 shares of MA, 4 shares of MSFT, & 8 shares of NKE

Alright, so I sold all shares of VCLT for a profit of $484~ and some change (which I may have to pay taxes on when I file for 2020) and used the proceeds to buy into my 3 new high growth/high dividend growth stocks. Mastercard, Microsoft, & Nike the plan is to scale these 3 holdings to $10,000 each. I really love the low payout ratios, high dividend growth, and capital appreciation. The most important key factor with these 3 stocks is growing my yield on cost/ capital growth. YOC is the real sh@t....... I see people on Facebook getting all excited over a 15% dividend yield??? I'm like you should be chasing 15% dividend RAISES. Yield on cost is not just some fancy term experienced investors use, it's some serious sweet dividend money. You guys always see me say on here sweet dividend money right? Well, a double-digit yield on cost is where the real sweet dividend money is at? Even with low dividend yields.

This reminds me of this one dividend growth investing YouTuber that's really obsessed with yield on cost. I think his name is Ian right?........you know that chill dude from the PPCIAN channel? Yeah, I heard he's a pretty cool guy 😉. Anyways below im going to explain why I bought into these 3 stocks, and why I absolutely love them despite their super-low yields of 1% and below.

Alight so Mastercard, first off I love the business. A financial technology transaction company, it's really a tech company but at the same time, it's my first financial related stock I ever owned. I absolutely LOVE the CEO "Ajaypal Singh Banga" who is an absolute beast, on what he's accomplished managing Mastercard over the last 10 years. Unfortunately, I just heard that 2021 will be his final year as CEO, but the CFO whos next in line should do just fine running Mastercard. I looked through their balance sheets from the last few years, and I just love pretty much everything I'm looking at. Great profit margins, a lot of liquid cash (or short/long term investments, etc), and the year over year revenue growth, because they pay so little of their income in dividends they re-invest most of it back into the business. This is good because with a business that has aggressive growth in its income they can afford to give out a 32% dividend raise like they did in 2018. If they chose to do so, obviously there's no guarantee but I like to position myself where I'm heavily invested in a business that has the ability to give out massive dividend raises. This wonderful CEO has made the early investors of Mastercard wealthy, on top of that these buy and hold investors are sitting on a very high yield on cost. They making some serious sweet dividend money because dramatically increasing the annual dividend payout is a lot more powerful than just a high dividend yield (like 5%) with DRIP and 1% or 2% dividend raises. It's great if you want to produce an income right now, but you're not going to see that dramatic 75 - 85 degree curvature in your year-over-year progress with dividend income. I also want to add that I appreciate their recent share buybacks as well.

I'm going to list a few of its current stats. Dividend yield 0.54%, dividend growth rate averages: 3 year = 22.05%, 5 year = 20.11%, & 10 year = 38.07% CAGR (compound annual growth rate). This is (TDGI) True Dividend Growth Investing folks, I just created that term off of thought in my head lol. Basically, you would ignore the starting yield and specifically analyze the dividend growth rates. The current payout ratio is 27.71% so the dividend is obviously safe, the dividend raise history is up to 9 years. So once they announce a 10th dividend raise in 2021. Mastercard will be ranked Dividend Contender, which are companies that have raised their dividend 10 years or more. Plus the business model is extremely safe............what are the odds that everyone from around the world is going to suddenly stop using there Mastercard. People would literally have to stop buying stuff or completely stop doing transactions in order for Mastercard to go out of business lol. So I'm 100% long Mastercard (MA), basically a growth stock with hidden long term passive income benefits, like the ability to produce a high yield on cost. Everyone wants to run away because of the yield, but some may not understand the mathematics behind those massive dividend raises stacked on top of one another year over year.

Alright so up next is Microsoft (MSFT), first off I love the business. I had to roll with my boy Bill Gates, my favorite billionaire of all time. So I really enjoyed analyzing all the different software businesses within Microsoft. Like Windows, Office 365, Microsoft Edge, the Xbox, and even Bing.com. Believe it or not, Bing.com is a 6 billion dollar business (info came from the CEO himself during an interview). Just getting a general idea of how much revenue all these software businesses/products bring in, and how they're growing their year over year cash flow. Microsoft CEO "Satya Nadella" is brilliant, I hope he gets extra comfortable and stays around for 10 years.

So I'm going to list down some of their current stats. The dividend yield is 1.03%, 17 years of dividend growth, and the payout ratio is 33.23%. (CAGR) 3 year = 9.54%, 5 year = 10.13%, 10 year = 14.28%. The balance sheet looks good, with lots of liquid cash in the bank. Is there really much more to say about Microsoft? I guarantee you that there's a retiree reading this that had a massive double-digit yield on cost from his (MSFT) holding. I know it sounds insane to say that you could build any kind of passive income from a stock that yields 1%, but those double-digit dividends raise's ain't no joke fellas. The math is telling me a different answer. Alright, let's scroll down to the final stock.

Alright so the final stock is Nike (NKE), ya boy needs to look smooth with his Nike athlete shirts, gym shorts, and tennis shoes while them sweet dividend money be rolling in. So again I love the business...........(message to the brand new investors) do you see a pattern? I invest in companies where I have an edge, which means you completely understand the products, profit margins, quarterly revenues, their debts........basically you understand how the business works and etc. You may have an edge with biotech companies, I don't know a single thing about biotech or how it works lol, I roll with mega-brands. Anyways so Nike leans more towards a retail product company but at the same time, they have serval different businesses like their endorsements with popular athletes like Lebron James for great advertisements. They also have this amazing athlete apparel for the Olympic athletes to wear and I just go on and on about their shoes lol. When I was in high school I wore nothing but Nike tennis shoes. For 4 years it was nothing but Nike shoes after Nike shoes, I also liked wearing the light Nike jackets (in all black with a tiny white Nike logo on the left side of the chest). I was looking a little smooth back in the highschool days lol :) Let's not forget about Nike CEO "John Donahoe", who has a wonderful bright vision for the future of Nike. Watched a ton of his interviews on youtube and love it. Cheers to "Phil Wright" (the founder), the Nike brand is EVERYWHERE you just can't escape it lol. So 100% long on Nike.

Now let's look over the current stats: Dividend yield is 0.78%, 8 years of dividend growth, payout ratio is 37.04% (CAGR) 3 year = 10.92%, 5 year = 11.73%, 10 year =13.69%. Low payout ratio + additional cash on hand for the business = the ability to re-invest to grow the value of the business and give out double-digit dividend raise's. The balance sheet looks wonderful as well, these lower-yielding stocks have some of the best balance sheets I've ever seen in the stock market. Amazing growth in year over year Free Cash Flow, I love to study companies net profits. There's really no need to take this any further, the conclusion is that these are wonderful businesses.

If a business is doing very well maybe Nike, Microsoft or Mastercard could give out a 15% - 20% dividend raise.........but if the business takes a hit in all quarterly earnings during a given year then they may need to go conservative by holding more cash/ revenue they produced and give out an 8%-12% dividend raise instead. You see what I mean? It's good to have an understanding of how dividend raise's are actually produced. Anyways guys I'm going to bring this one to an end. MA, MSFT, NKE are my new high growth/ high dividend growth projects that I'll be scaling up to $10,000 each inside my Taxable account portfolio. I also want to add that these 3 companies will payout their dividend on a rotating basis every month ;). MA will pay its first dividend of $2.20 in February, MSFT will pay its first dividend of $2.24 in March and NKE will pay its first dividend of $2.20 in April. Then it would rotate over and over again. Pretty cool right? I'm a mathematics nut.

Alright guys I hope you enjoyed this special year-end blog post. Looking forward to pushing the taxable account full-throttle throughout 2021, and ill see you guys in the next update ;)