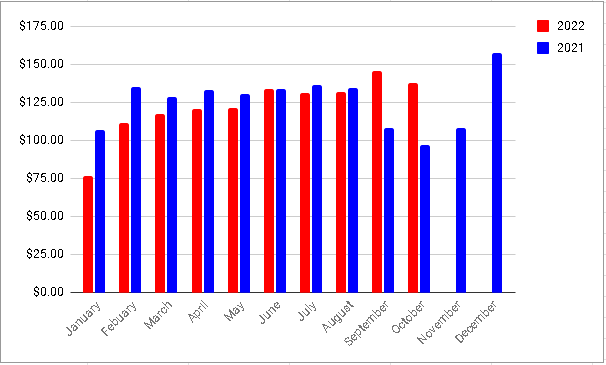

Welcome back to the most unorthodox investing blog you will ever come across on the Internet. My favorite songs during September was 🎶 "Nookie" and "My Way" by Limp Bizkit 🎶. A 16 hour day feels so f$$king good 😈 🔥🔥🔥 its soo hard to stop. I'm like a formula one driver that loves embracing those brutal lateral G force's when your aggressively braking & accelerating throughout the turns on track and then topping out at 200 mph on the long straights over and over and over again. (#Full Throttle 🏁 ) My average contributions month by month are averaging between $2,000 to $3,000 a month. When I was 16 years old in high school I already had a feeling that I was going to grow up and be abnormal with money in my 20s. I'm not surprised, at 16 years old I was watching old YouTube videos on how to franchise a "Dollar tree" store, and I was sooooo OBSESSED with videos of Billionaire's. I don't know what life is like where your not pursing "wealth"...... I'm totally ignorant to that. Back in highschool already knew I was going to be "different". So there's a little "behind the scenes" treat to the very few that actually clicks and read the blog updates. So as usual scroll down to the dividend income.

Roth IRA

Total: $119.64

Taxable Account

Total: $25.80

Grand Total: $145.44

Dividend Raises: MSFT = 9.68%, INTU = 14.7%

Purchases: 4 shares of (MPWR) ($1,589.18) & 2 shares of (NVDA) ($247.08)

(MPWR) Monolithic Power System is my second semi-conductor stock addition to the Taxable Account. Unlike (NVDA) which is my only long term "growth" position, this one is high dividend growth/high growth style single stock. This is the last "new" high-conviction single stock that ill be buying for 2022 & 2023. For the regular brokerage account, I will not be buying into any new positions until 2024. I just want to scale up my positions and the consistently dollar-cost average for the next 14 to 16 months as we could possibly hit the bottom or the market continues to crash either way I'm still buying more shares. For the Roth IRA ill be selling and replacing some positions with better single stocks. For right now I'm doing nothing with my Roth IRA, other than consistently building a cash position. The brokerage account by default is my primary account so don't expect much activity with the Roth IRA. So scroll down below to take a look at some info/metrics on my new addition to the Taxable Account (10 positions total).

Company summary: Monolithic Power Systems, Inc. engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions for the computing and storage, automotive, industrial, communications, and consumer markets. The company provides direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as portable electronic devices, wireless LAN access points, computers and notebooks, monitors, infotainment applications, and medical equipment. It also offers lighting control ICs for backlighting that are used in systems, which provide the light source for LCD panels in notebook computers, monitors, car navigation systems, and televisions, as well as for general illumination products. The company sells its products through third-party distributors and value-added resellers, as well as directly to original equipment manufacturers, original design manufacturers, electronic manufacturing service providers, and other end customers in China, Taiwan, Europe, South Korea, Southeast Asia, Japan, the United States, and internationally. Monolithic Power Systems, Inc. was incorporated in 1997 and is headquartered in Kirkland, Washington.

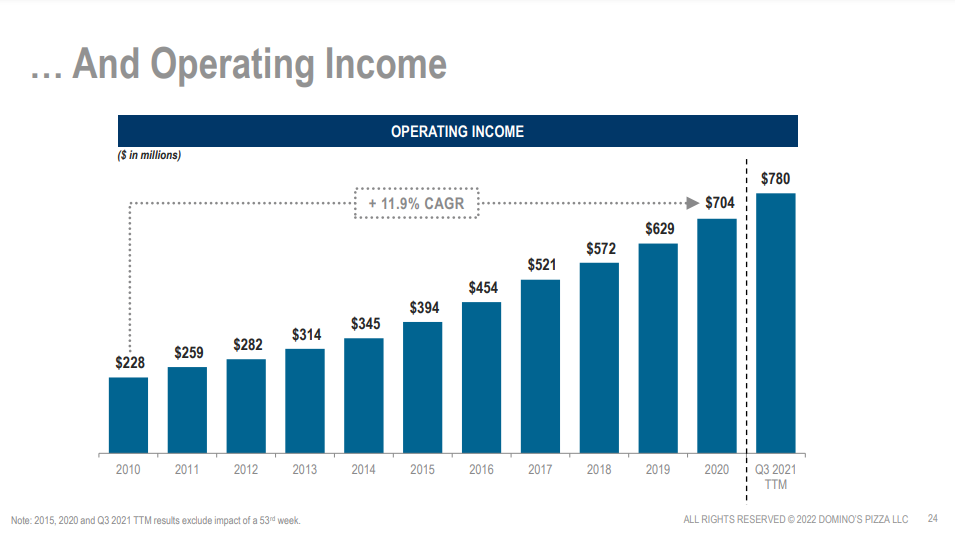

Dividend Growth

During the last 5 years (MPWR) has grown it's annual dividend by 200%.

Dividend stats: current yield = 0.91%, 4 years of dividend growth, payout ratio = 23.33%, 3 Year CAGR = 23.86% 5 Year CAGR = 28.93%

Total Return

(10 years)

Revenue Growth

Business Collaborations

That's it for this update.......until next time.